new short term capital gains tax proposal

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax. There are a few higher rates for particular items but they dont apply to a home sale.

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

7 rows Federal short-term capital gainsincome tax rate Single Married filing jointly Married.

. Under Bidens proposal for capital gains the US. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to. Taxing short-term capital gains at 5 down from the current 12 would save about 150000 taxpayers 117 million.

Short-term capital gain is generally taxed as ordinary income. Short-term capital gains would continue to be taxed at ordinary income rates. The plan proposed by House Democrats will also add a 3 percent tax for those with modified adjusted gross income above 5 million from 2022 and on top of that increasing the.

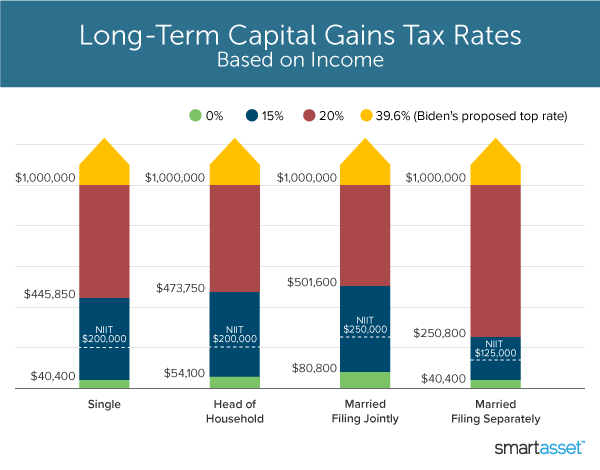

For taxpayers with income above 1 million the long-term capital gains rate. Proposed capital gains tax Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest. The bill proposes to treat short-term capital gains the same as.

The long-term capital gains tax rate varies between 0 15 and 20. Ad Make Tax-Smart Investing Part of Your Tax Planning. The proposal by House Democrats will also impose a 3 percent surtax for those with modified adjusted gross earnings of more than 5 million beginning in 2022 along with.

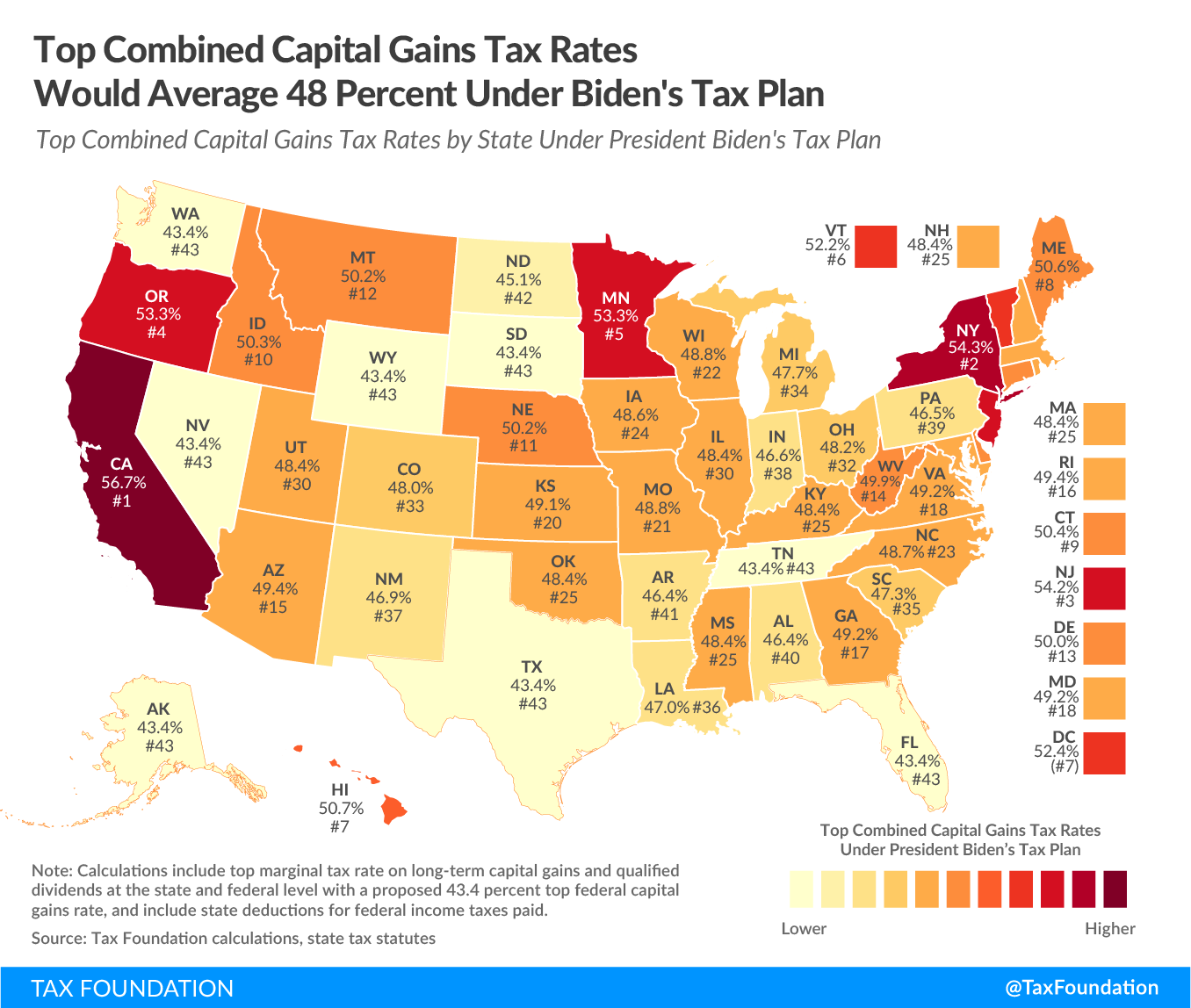

Connect With a Fidelity Advisor Today. Economy would be smaller American incomes would be reduced and federal revenue would also drop due to fewer capital. Connect With a Fidelity Advisor Today.

In either case the gain is calculated based upon the difference between the owners basis generally cost plus. The 2021 Washington State Legislature recently passed ESSB 5096 RCW 8287 which creates a 7 tax on the sale or exchange of long-term capital assets stocks bonds business interests. The capital gains tax rate is proposed to go up from 20 percent to 25 percent and 396 percent on shortterm capital gains.

In 2019 more than 150000 filers from every income level paid the tax more than 61000 of whom had incomes below 112000. The increase in the highest long-term capital gains and dividend rate is lower than that proposed. The IRS taxes short-term capital gains like ordinary income.

For federal taxes the crypto tax rate is the same as the capital gains tax rate. The rate will apply to those in the top tax brackets for. Short-term capital gains are taxed at 10-37 while long-term capital gains are taxed at 0-20.

The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level. Ad Make Tax-Smart Investing Part of Your Tax Planning. It would apply to those with.

Bakers budget proposal marks the beginning of the. Veuer The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396. Veuers Sean Dowling has more.

How High Are Capital Gains Taxes In Your State Tax Foundation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Accounting Taxation Income Tax Audit Requirements Interest Rates Penalty Appel Fees Deductions Capital Gain Rates Income Tax Income Tax Return Income

What S In Biden S Capital Gains Tax Plan Smartasset

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Pin By Karthikeya Co On Tax Consultant Mutuals Funds Capital Gain Fund

Rethinking How We Score Capital Gains Tax Reform Bfi

Capital Loss Set Off Rules On Sale Of Stocks Equity Mutual Fund Schemes Mutuals Funds Budgeting Fund

Selling Stock Are There Tax Penalties On Capital Gains The Motley Fool

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

How To Maximize Year End Taxes After A Layoff Or Early Retirement

Oregon S Capital Gains Tax Is Too High Oregonlive Com

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy