where do i pay overdue excise tax in ma

A vehicles excise valuation is based on the manufacturers list price MSRP in the vehicles year of manufacture. Drivers License Number Do not enter vehicle plate numbers.

Wtf Massachusetts R Massachusetts

When you register your motor vehicle or trailer you have to pay a motor vehicle and trailer excise.

. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Please contact the treasuercollectors office or our Deputy Collector Kelly and Ryan Associates at 508-473-9660. Motor Vehicle Excise Tax Wellesley Ma.

Find your bill using your license number and date of birth. This can take up to 90 days. You must make payment in cash money order or cashiers check to have the.

Various percentages of the manufacturers list price are applied as. All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. The city or town where the vehicle is principally garaged levies the excise and.

Online Payment Search Form. How do I pay overdue Excise Taxes that have been marked at the Registry of Motor Vehicles for non. Payment at this point must be made through our Deputy.

General Overview Massachusetts General Law Under Massachusetts General Law MGL 60A all residents who own a motor vehicle must pay an annual excise taxThe tax is generated by the. If you dont make your payment within 30 days of the date the City issued the excise. All corporations that expect to pay more than 1000 for the corporate excise tax have to make estimated tax payments to Massachusetts.

It needs to pay. Request for a Certified Abutters List. THIS FEE IS NON-REFUNDABLE.

Birth Death Dog License Violations etc. All bills are based on the information in the RMV database. Bills for the calendar year 2021 have been issued and will.

Excise Real Estate Personal Property etc Town Clerk. To find out if you qualify call the Taxpayer Referral and Assistance Center at 617-635-4287. If you are unable to find your bill try searching by bill type.

The deputy collector is located at different registries in massachusetts. Online Bill Pay for Real Estate Personal Property. Payment at this point must be made through our Deputy.

Please contact the Town of Winchendon Assessors Office for abatement information. Corporate excise can apply to both domestic and foreign corporations. Current Fiscal Year Tax Rate.

Visit their website here. Corporate Excise Tax. Request for Tax Information.

Get the ins and outs on paying the motor vehicle excise tax to your city or. Motor Vehicle Excise Tax. Massachusetts imposes a corporate excise tax on certain businesses.

You must file for abatement with the Athol Assessors office if you are entitled to abatement. You must pay the excise tax bill in full by the due date. Please note all online payments will have a 45 processing fee added to your total due.

They also have multiple locations you can pay including Worcester RMV Leominster RMV and other locations listed on their website. How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Excise taxes are issued throughout the year when commitments are received from the Registry of Motor Vehicles.

WE DO NOT ACCEPT.

Massachusetts Sales Use Tax Guide Avalara

Treasurer Collector Town Of Montague Ma

Sales Taxes In The United States Wikipedia

How To Pay Your Motor Vehicle Excise Tax Boston Gov

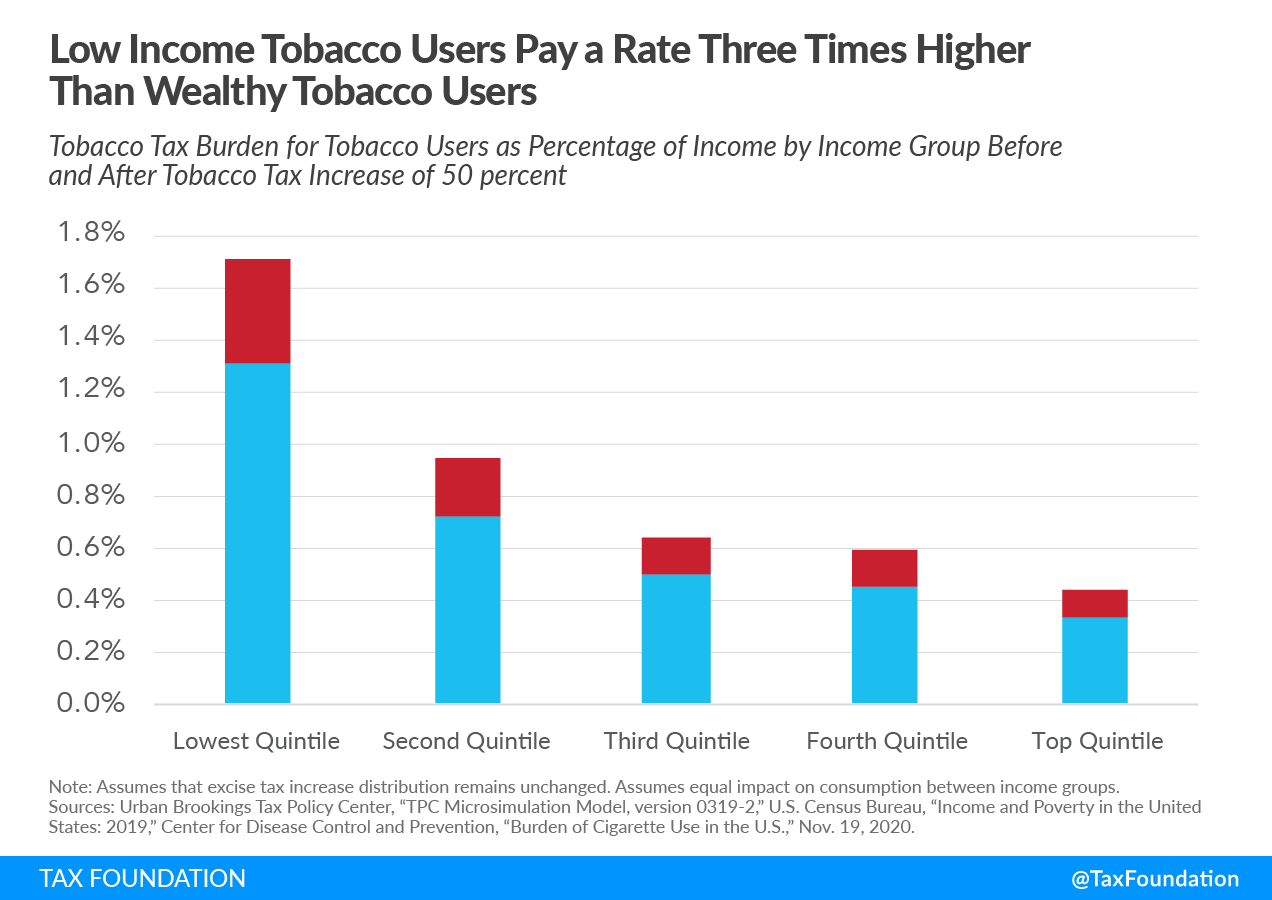

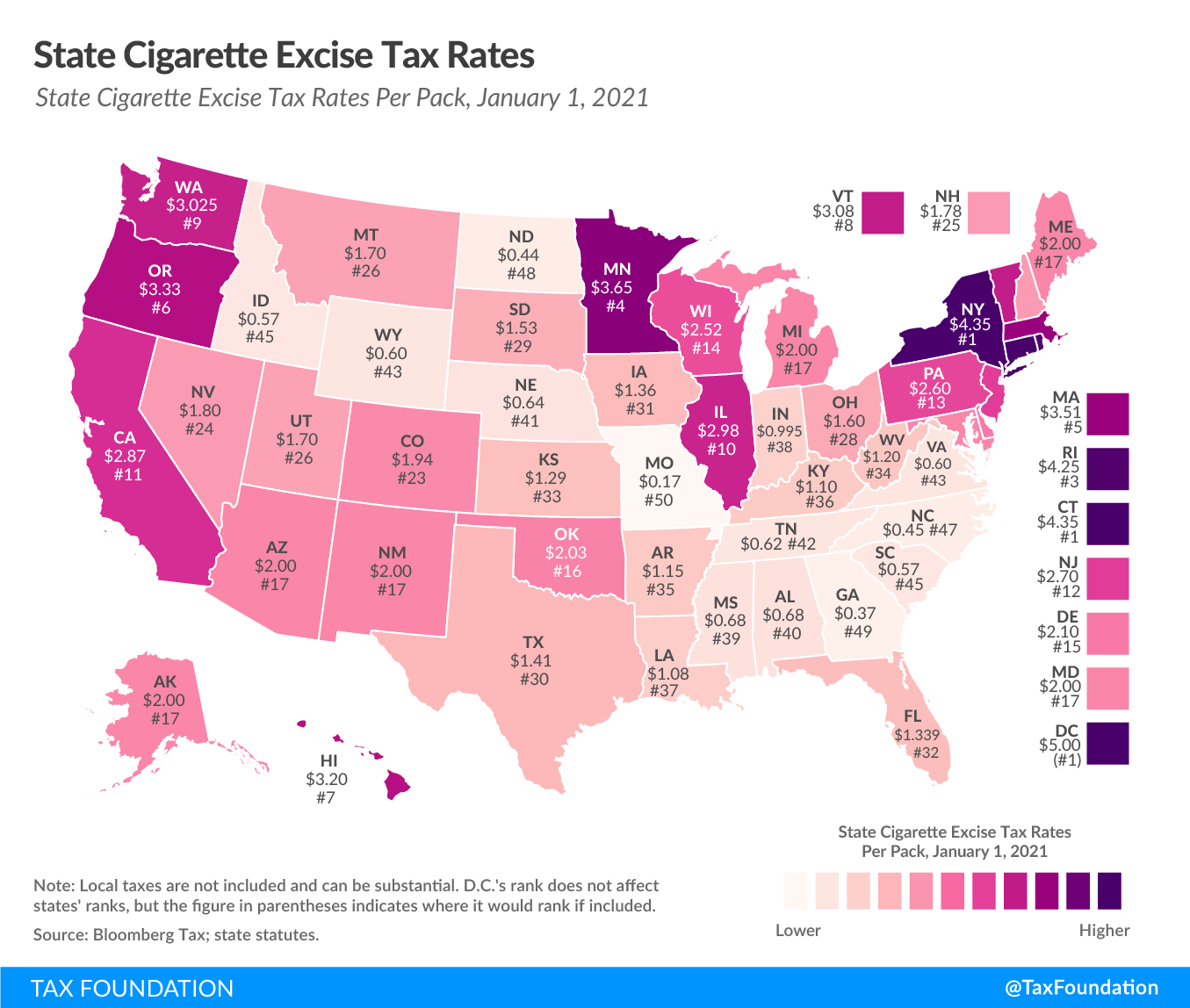

Excise Taxes Excise Tax Trends Tax Foundation

Look Up Pay Bills Town Of Arlington

Coronavirus Weymouth Extends Tax Payment Due Dates Weymouth Ma Patch

Excise Taxes Excise Tax Trends Tax Foundation

Marijuana Excise Taxes Outpace Alcohol In Massachusetts

A Guide To Your Annual Motor Vehicle Excise Tax Wwlp

Edelstein Company Llp Tax Alert Massachusetts Enacts Elective Pass Through Entity Excise

Motor Vehicle Excise Taxes Royalston Ma

Wtf Massachusetts R Massachusetts

Town Of Avon Ma From The Treasurer Collector And Assistant Tax Collector Warrant Phase For Excise Bills That Were Due On August 25 2021 The Treasurer Collector And Assistant Tax Collector Advises Residents